Power Generation Industry Forecast: Natural Gas as Fuel of Choice, Little Change for Other Technologies (Part I of II)

By Robert Peltier and Kennedy Maize -- January 13, 2010“It’s déjà vu all over again,” said Yogi Berra. The baseball Hall of Famer could easily have been predicting the coming resurgence of new natural gas–fired power plants. A couple of nuclear plants may actually break ground, but don’t hold your breath. Many more wind turbines will dot the landscape as renewable portfolio standards dictate resource planning, but their peak generation contribution will continue be small (and disappointing).

The most interesting story for 2010 is that the dash for gas in the U.S. has begun–again. In Part II or this two-part report, we will explore the challenges facing nuclear, coal, and renewable energy electricity sources in 2010 and beyond.

Business Climate–Energy Demand

As we enter the second decade of the 21st century and a second year of avoiding an economic collapse, the U.S. business climate seems to have become more positive. A growing sense of cautious optimism is appearing. A mid-October survey by the National Association for Business Economics concluded that the largest recession since the 1930s Great Depression is over, and economic growth is likely for the U.S. economy in 2010. The government announced that third-quarter 2009 economic growth hit 3.5%, the first positive growth in five quarters, suggesting an end to the recession (Figure 1).

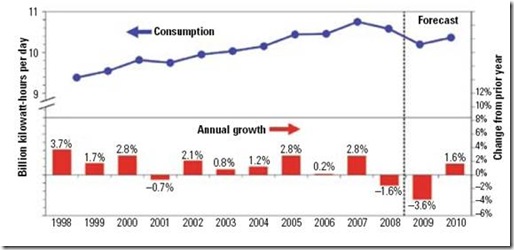

Figure 1. Electricity growth resumes in 2010. After a two-year contracting market, total electricity consumption in the U.S. in 2010 is expected to increase. Source: EIA, November 2009 Short-Term Energy Outlook

The implications for electric generation are mixed. What gets built depends on a complex stew of credit markets, regulatory responses, economic growth, technology, and national politics. Some of those are leading economic indicators, some lagging, some not clear at all.

Renewable generation has not made a convincing economic case in the market. But politically it has the upper hand. Coal and nuclear continue to take a political battering at the hands of the renewables advocates. The politics of energy is being upended by new implications for natural gas. The political and regulatory landscape is a dog’s dinner (a Britishism for an undigested mess).

The need for new generation to supply load appears less urgent than in previous years. According to the EIA, demand for electricity has fallen since the economy tanked in 2008. The demand down-tick is the first since the EIA has accumulated these statistics in 1977.

Facing a sluggish economy, consumers have reduced thermostats, cut off air conditioning, and dialed down appliances, leading to the decline in electricity demand. A cool 2009 summer in most of the U.S. helped to reduce air conditioning load. Net electric generation dropped 6.8% from June 2008 to June 2009. That was the 11th consecutive month that electric generation slid downward, compared to the same month in the prior year.

Analysts say they expect the declining demand trend to reverse when economic growth shows up at the beginning of 2010 or thereabouts. But they have been wrong before and may be wrong again. The EIA, the U.S. Department of Energy’s statistical agency, says it suspects the decline in demand will continue into early 2010, despite what appears to be a bottoming-out of the recession.

Many electric power company long-term capital spending plans have been built on the dire forecasts of the past decade, particularly from NERC. For years, the conventional wisdom in the generating industry was that the U.S. was running out of generating capacity. Year after year NERC had the same message: It’s time to build baseload, particularly nuclear and coal, and make major investments in high-voltage transmission.

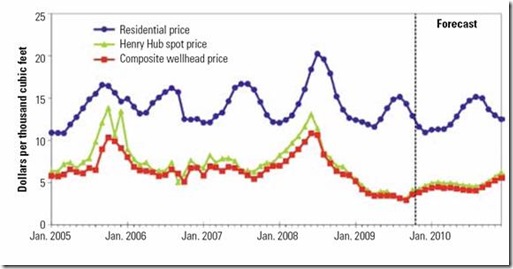

Maybe not. Intermediate-load and peaking units, suggesting new gas plants, may be the ways to hedge big investment bets on future baseload units. A recent Washington Post article quoted anonymous sources as saying that new nuclear plants aren’t economical until natural gas prices are above $7/mmBtu. That’s more than double the current price.

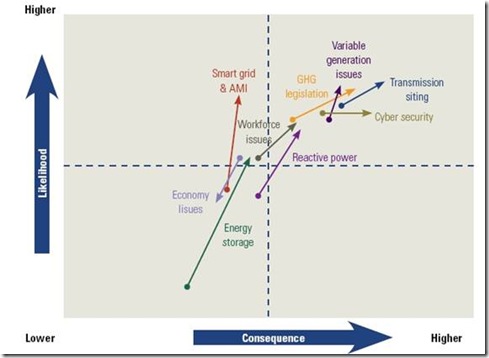

The urgency for long-distance, high-voltage electric transmission investment, premised on optimistic estimates of growth in demand, also seems to have declined. Capital requirements for the big transmission projects, along with the political risks, have scared off investors, including conventional utilities and free-standing investment companies. Those who want to build large transmission systems linking areas of surplus power generation (West Virginia, for example) to big markets in New Jersey and New York are facing not only citizen opposition but also indifference from Wall Street investors, who don’t see an acceptable market return on investment (Figure 2).

Figure 2. New transmission is key in future years. The North American Electric Reliability Corp. predicts that expanding critical transmission capacity will be a national priority over the next five years. Source: NERC

The bullish generating market in late 2008—despite signals of a worldwide economic crisis—turned into a financial quagmire. Today, lenders are unwilling to pony up cash for new generation and transmission without guaranteed returns, regulators are reluctant to bless projects without iron-clad promises of stable prices, and customers are unwilling to support new projects that threaten rate hikes and environmental impairment. Governments at the federal and state level are demonstrating distinct ambiguity about generation and transmission projects.

Where does that land us? Overall, the generating market has slowed. Raising credit has become difficult for major projects of any kind, from new nuclear reactors to petroleum refineries to coal mines. Money wasn’t a problem a decade ago. Today, it’s a big problem. Tomorrow, meaning 2010 and beyond, that may change. But don’t bet the company. It’s a jungle out there.

The Political Environment for Power

After a year with a new political crew in Washington—Democrats in the White House and controlling both the House and Senate—how has the political landscape for electric generation changed? It’s not clear. Democrats have said they want substantial reforms in the way the nation addresses energy, including the alleged specter of climate change. The party, including the Obama administration, is pushing legislation in Congress that appears unlikely to be enacted this year.

Complicating the administration’s policy agenda, the political clock has already started ticking toward the 2010 mid-term elections, when all of the U.S. House and a third of the Senate seats are up for election. Traditionally, the party in power loses seats in off-year elections. The Obama administration likely will take heroic steps to prevent that outcome, particularly to ward off losing the Democrats’ 60-40 margin in the Senate, where it takes 60 votes to avoid a filibuster. Ducking a filibuster is a prerequisite for passing Senate legislation in these days of total partisan warfare.

In that context, what has changed since 2009 when it comes to energy legislation and the economic prospects for energy development? Paradoxically, very little. The administration promised new directions in energy, with an emphasis on controlling greenhouse gas emissions and increasing energy efficiency, without much in the way of specifics. The Obama administration attempted to create a dramatic picture of how it differed from the Bush administration. The optics succeeded, but the reality is far less than meets the eye.

The Obama administration’s position on energy legislation is not very different from that of its predecessor. Both offered generalities and platitudes but not much practical red meat. The current administration has largely stayed away from the legislative details of climate legislation (as it has done with health care). The House passed a cap-and-trade bill (Waxman-Markey) that takes the approach that if the policy causes you any pain, we will pay to make you feel better. Republicans correctly call the House bill “pork” but have had nothing to offer in response.

The Senate Environment and Public Works Committee bill is not much different than the House-passed measure and leaves many details to be fleshed out in markup in the committee, chaired by California Democrat Barbara Boxer, an enthusiast for measures to control greenhouse gas emissions. Republicans have indicated that they will be unanimous in attempting to block the bill. The GOP may be able to pick a few Democrats to oppose the Boxer bill, dooming the legislation. In November, the Democrats reported out the committee bill, without Republican participation, as the GOP boycotted the committee markup session. That does not bode well for legislation anytime soon.

The Senate Energy and Natural Resources Committee, chaired by New Mexico Democrat Jeff Bingaman will also have a powerful legislative and political oar to dip into energy policy waters. Bingaman’s state is a major producer of coal, natural gas, and uranium, but it is a minor state when it comes to electricity production. How he will approach the greenhouse gas issues is not clear.

Four more Senate committees will have a say in the final legislation. Energy politics tend to be regional, not ideological, as both parties are prepared to spend taxpayer dollars for fuels and technologies that touch their constituents.

The legislative fight could carry deep into 2010 without resolution.

Record Gas Reserves Discovered

“Holy cow, there’s a lot of gas.”

That was the reaction of Penn State geologist Terry Englander, as reported in the Massachusetts Institute of Technology’s Technology Review last October. Three years ago, Englander was asked to assess the natural gas potential of Marcellus shale deposits in the U.S. Midwest and Mid-Atlantic regions. It now appears that deep shale beds—the Carboniferous (350 million years ago) Barnett shale deposits in the Texas and the enormous Devonian (400 million years ago) Marcellus shale deposits in the East—could be game-changers in the U.S. energy and power generation markets for years to come.

Shale formed in those deposits contained methane bound so tightly into the rock formations that conventional drilling technology could not get at it, according to the geologists. That’s changed. Deep drilling, horizontal drilling, and hydraulic fracturing (pumping water down the borehole at great pressures to shatter the shale strata, releasing the methane from the rock) make the gas accessible. Both shale finds are providing drillers with gas bonanzas.

Last June, the U.S. Potential Gas Committee (PGC) issued a report that estimated total U.S. natural gas reserves at over 1,800 trillion cubic feet, the highest in the committee’s 44-year history, and 40% above its 2006 estimate. John Curtis of the Colorado School of Mines, head of the PGC, said that the estimate “reaffirms the committee’s conviction that abundant, recoverable natural gas resources exist within our borders, both onshore and offshore, in all types of reservoirs.” Prices fell, reflecting the optimistic supply predictions. Exploration in shale deposits continued growing.

The PGC is an independent, industry-funded technical group that examines natural gas reserves in the U.S. Said Curtis, “Our knowledge of the geological endowment of technically recoverable gas continues to improve with each assessment. Furthermore, new and advanced exploration, well drilling, and completion technologies are allowing us increasingly better access to domestic gas resources—especially ‘unconventional’ gas—which, not all that long ago, were considered impractical or uneconomical to pursue.” That’s a reference to shale gas, as well as gas in deep deposits.

Significantly, the shale gas deposits are close to, and in some cases, directly underneath, natural gas pipelines and gathering hubs and near large markets. Bringing the gas to market could be easy and cheap.

In a press release, the PGC noted, “When the PGC’s results are combined with the U.S. Department of Energy’s latest available determination of proved gas reserves, 238 Tcf [trillion cubic feet] as of year-end 2007, the United States has a total available future supply of 2,074 Tcf, an increase of 542 Tcf over the previous evaluation.”

That’s a stunning figure—an increase of over 25% above previous estimates. The Energy Information Administration (EIA) defines “proved reserves” as “those volumes of oil and natural gas that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions.” In other words, they are real.

The supply optimism is good news for existing and potential electric generators, as the projections, bolstered by successful drilling in shale, have resulted in dramatically lower natural gas prices. The most recent reports from the EIA found natural gas prices at the Henry Hub at $2.76 per million Btu (mmBtu). Futures prices at the New York Mercantile Exchange for September 2009 contracts were at $2.91 per mmBtu. A couple of years ago, the NYMEX price was in the $9 range for short forward contracts (Figure 3).

Figure 3. Gas prices expected to stabilize in 2010. The U.S. Energy Information Administration (EIA) predicts natural gas prices will fluctuate less and be more predictable in the future given the significant increase in gas reserves. Source: EIA November 2009 Short-Term Energy Outlook

Say Goodbye, LNG?

Among the implications of the optimism about shale gas recovery in the U.S. is a crash landing for plans to build imported liquefied natural gas (LNG) terminals in the U.S. Three years ago, LNG was the rage of the age, with predictions of terminals across the coastal U.S. Daniel Yergin’s Cambridge Energy Research Associates (CERA) was bullish on LNG, predicting a worldwide LNG boom.

No longer. No recent publicly available material on LNG has shown up on the CERA web site, although there was reporting available to paying customers (the price tag is very high). Could the consultancy’s enthusiasm for LNG have cooled considerably on current and projected natural gas prices? The guess here is that it has.

On the other hand, CERA’s web site now touts shale gas, saying, “Some call it a revolution,” adding that shale gas “could change the global natural gas balance.”

To date, according to the Federal Energy Regulatory Commission (FERC), four new LNG terminals are under construction in the U.S., with just under 4 billion cubic feet of gas capacity. Three of the four are in the Southeast or Southwest, where they serve petrochemical plants. FERC has approved another 14 LNG projects for the U.S., but analysts expect few of those will actually see the light.

Summarizing its most recent data, the Energy Information Administration (EIA) said, “In 2008, increased U.S. natural gas production led to reduced demand for natural gas imports. The drop in total imports occurred despite a 2007-to-2008 increase in domestic consumption—a factor that typically requires higher levels of imports to meet consumer demand. Total exports to Mexico and Canada via pipeline and Japan via LNG tanker were higher in 2008. Consequently, net imports to the United States fell more than 20 percent from 2007 totals to the lowest level since 1997. The decline in U.S. natural gas imports had a larger impact on LNG imports than Canadian pipeline imports. Given the ease of transporting gas to alternative markets, some LNG that historically landed in the United States went elsewhere in 2008.”

The EIA went on to say that “The increased supply of LNG brought about by the start-up of several large LNG supply projects in late-2009 and in 2010 contributes to an increase in the outlook for U.S. LNG imports next year. However, the timing of these new liquefaction additions is extremely difficult to judge.”

Favorite Power Generation Fuel Returns

For 2010, gas sees its prospects gaining in the power market, bolstered by new technology and large new supplies. The leader of the generating pack in the 1980s and early 1990s, gas went into a deep decline on high prices and diminishing reserves in the first part of the 21st century. Many analysts said the days of gas as a major generating fuel were over.

No more. Given that gas is less polluting than coal (by any measure), produces half as much carbon dioxide (CO2) per unit of energy output, and requires plants that are quick to build and not capital-intensive, new gas reserves appear to position the fuel as a winner in generating markets. The U.S., once seen as a declining gas producer, may be a world leader in gas.

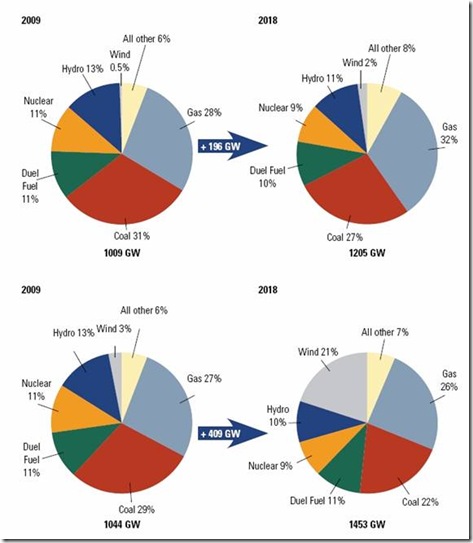

In November, The Energy Daily reported that the North American Electric Reliability Corp. (NERC) has found that “Electric utilities are increasingly showing an ‘overwhelming’ preference for building natural gas–fueled plants, a trend that is expected to drive gas past coal as the dominant North American fuel for on-peak power production by 2011.” According to the newsletter, “NERC said both regulated utilities and merchant generators are increasingly favoring gas plants because the fuel has been discovered in more abundance and is cheaper than in the past. In addition, gas plants are easy to site, can be built quickly and produce less carbon emissions than other types of traditional generation.”

This overabundance of natural gas reserves may also have a downside, according to a report released by NERC on October 29. NERC’s “2009 Long-Term Reliability Assessment 2009–2018” report notes that natural gas–fired on-peak power production may push past coal-fired generation by 2011, portending system reliability problems. NERC also cited cyber-security concerns, the integration of fast-growing renewable resources into the grid, and uncertainties created by the economic slowdown as emerging reliability worries that it faces (Figure 4).

Figure 4. Demand for electricity will rise in 2010. The top figure describes the expected growth of capacity that will be available during peak hours. The bottom figure describes the expected growth of installed capacity. Coal and gas will continue to be the fuels of choice during peak generating hours. Wind generation will continue to grow faster than any other but will contribute little to peak supplies. Source: NERC

NERC recognized that existing reserve margins are adequate across the U.S. for the next few years, but the first priority must be to expand the grid and increase the capacity of existing transmission and distribution systems to handle the expected growth of renewable generation. The report concluded, “More than 11,000 miles (or 35%) of transmission (200 kV and above) proposed and projected in this report must be developed on time to ensure reliability over the next 5 years. 32,000 miles of transmission (200 kV and above) are projected for construction from 2009 to 2013 overall.” NERC strongly believes that transmission siting and construction is the most urgent issue for the power generation industry, now and well into the future.

Electricity growth has stalled over the past two years, given the chaos in the global economy. However, NERC projects that demand will increased 15% between 2009 and 2018, compared to its 17% forecast in last year’s report. The projected demand increase has steadily decreased over the past several years. Once again, NERC underlined the need for grid expansion and new transmission capacity to handle renewables and ensure reliability, with particular urgency seen in areas of the Southwest.

“These competitive advantages have resulted in an overwhelming preference for electricity over the ten-year period, as installed natural gas capacity is projected to increase 38 percent over the ten-year period, while coal is projected to increase by only 6 percent,” NERC’s assessment said. Its predictions of demand for new generation have been overly generous in the past but now appear to be more realistic (Table 1). The EIA predictions of electricity demand growth do not include peak demand growth as a separate category, but rather predict energy consumption will grow 8.2% through 2018. Together, the NERC and EIA data clearly show that the need for additional, dispatchable load during on-peak hours will be a primary focus for electricity system planners. Expect more gas-fired reciprocating engine and combined-cycle plants designed for intermediate peaking service to be announced in the coming year.

Table 1. Electricity use increases, slowly. The North American Electric Reliability Corp. (NERC) expects the rate of peak demand and energy consumption growth to slow in coming years. Source: NERC

Further, NERC said that “on-peak natural gas capacity is projected to grow by more than double the amount of any other resource, and by more than five times any other resource when dual fuel resources (primarily fired by natural gas and another, alternate fuel) are excluded.” NERC said a “plausible” future scenario involves flat or negative power demand growth for the next seven or eight years, followed by an “abrupt change to normal or high demand growth.”

From NERC’s perspective, however, that trend is not all good. NERC said the growing reliance on gas could create grid problems if gas usage strains the infrastructure that delivers gas to power plants. “The projected growing reliance on natural gas increases the potential for adverse reliability impacts due to fuel supply and storage and delivery infrastructure adequacy issues,” NERC said.

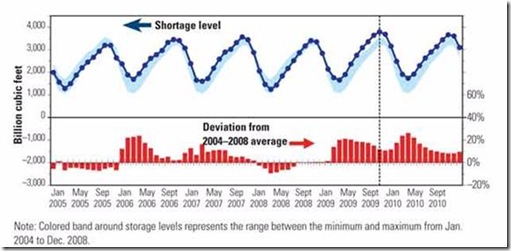

Increased gas demand this past summer already put a strain on existing gas transmission infrastructure. Chesapeake Energy Corp. admitted that it briefly slowed production because natural gas pipelines and gathering systems were already operating at maximum capacity (Figure 5).

Figure 5. Gas storage and pipelines full in 2010. An excess of natural gas is packing gas lines and storage facilities. Shown is the predicted rate of natural gas storage for 2010 compared to historic amounts. Source: EIA November 2009 Short-Term Energy Outlook

Unexpected Trend: Fuel Switching

When the Acid Rain Program under the Clean Air Act took effect in 1995, utilities searched for ways to avoid installing expensive flue gas desulfurization systems. One approach much favored by plants in the eastern U.S. was to perform a boiler fuel switch from high-sulfur eastern bituminous coal to low-sulfur Powder River Basin coal. A side benefit was that the coal was significantly less expensive to purchase, even if the delivery charges were much higher given where the coal is mined. Today, with the nation expected to be awash in natural gas, several utilities have announced plans to, in essence, fuel switch from coal to natural gas.

A good example is Progress Energy Carolinas’ August announcement of its plans to permanently shut down three coal-fired power plants near Goldsboro and, in exchange, construct a new, high-efficiency, gas-fired 950-MW combined-cycle power plant. The business case for the fuel switch is compelling. The utility gets bragging rights, not to mention emissions credits, for shuttering three coal plants totaling almost 400 MW at the H.F. Lee Plant in Wayne County. The utility makes a compelling case that its plan will reduce overall emissions (including those of CO2, should carbon controls eventually become law), increase the efficiency of electricity production in its system, and, if natural gas prices remain low, lower the cost of electricity production. The cost of the new intermediate-load plant, expected to be in service by 2013, is estimated to be around $900 million.

A final advantage to Progress Energy: Adding a natural gas–fired plant will broaden the company’s fuel resource base away from coal and nuclear. As a side benefit, shuttering the older three plants sidesteps the requirements of North Carolina’s Clean Smokestacks Act, which established very aggressive emission-reduction targets in 2013. Instead of cleaning up the old plant, Progress Energy decided it was wiser to invest the money in a new plant.

“This is an important milestone for our company and for our state,” said Lloyd Yates, president and CEO of Progress Energy Carolinas. “The Lee Plant has been producing electricity reliably and cost-effectively for our customers for more than 50 years, but as emission targets continue to change, and as legislation to reduce carbon emissions appears likely, we believe in this case, it’s in the best interest of our customers to invest in advanced-design, cleaner-burning generation for the future.”

Yates went on to say, “Our objective is to maintain the right balance of resources—nuclear, natural gas, coal, hydroelectric, solar, biomass, and energy efficiency—to make our company and state more energy independent and to minimize the risk of customer price spikes due to volatility in cost or supply of any single fuel source.”

The economic advantage to Progress Energy is apparent, but in an unusual display of harmony, North Carolina regulators have disarmed all the explosives in the usual regulatory minefield encountered when permitting a new gas plant. The North Carolina General Assembly recently approved legislation to facilitate a fuel or technology replacement project as Progress Energy has proposed. Senate Bill 1004 established a streamlined certificate process (45 days versus the standard six months or more) to enable Progress Energy to shut down the coal units and replace them with natural gas–fueled technology. The shorter certification period was needed to enable the company to replace the coal-fired plants by 2013, when the stricter statewide emission targets come into effect.

Expect additional state legislatures to quickly open an express lane for permitting gas-fired combined-cycle plants that replace older, less-efficient ones. Utilities will quickly respond to this economic carrot faster than the regulatory stick.

The second emerging fuel-switching trend is retooling a coal plant to burn other fuels in order to help meet state renewable portfolio standards and to avoid costly emissions equipment retrofits.

The most interesting project in this genre of plant makeovers is FirstEnergy Corp.’s plan, announced in April, to repower two units at its R.E. Burger coal-fired power plant to burn biomass. Those two coal-fired units, totaling 312 MW, would become the largest biomass power plants in the U.S.

Burger Units 4 and 5 were targeted by the Environmental Protection Agency for alleged violations of the Clean Air Act’s New Source Review provisions. A consent decree signed in 2005 settled those charges but gave FirstEnergy until midnight March 31 to decide whether to shut down the units or agree to retrofit with expensive air emission control equipment estimated to cost $330 million. Instead, the utility decided to invest $200 million to convert the two units to burn biomass. The fuel switch also furthers FirstEnergy progress toward meeting Ohio’s standard that requires utilities to obtain 25% of their power from renewable resources—at least half of which must be generated within Ohio.

According to First Energy, the two Burger units will use wood wastes and other biomass to fuel the facility. FirstEnergy’s goal, however, is to operate the plant as a “closed loop” or carbon-neutral biomass plant, which means it will use fuel derived from trees grown to serve as feedstock for the biomass. The energy crop trees would act as a carbon sink, storing carbon in the trees’ tissues and roots.

When harvested and burned, the stored carbon would be released, but the net carbon footprint would be zero. Fast-growing, bioengineered cottonwood trees and grasses grown in Ohio will be harvested and pressed into cubes before delivery to the plant. The plant will then pulverize and blow the biomass fuel into the boiler in much the same way as coal plants use pulverized coal.

A number of other utilities have announced similar plans to retrofit fossil-fueled plants to burn biomass fuels. Over the past three years, Southern Co., Northeast Utilities, Dynegy, Xcel Energy, and DTE Energy have either converted plants or are in the process of doing so.

More to Come

In Part II, we will predict what the future holds for the remaining fuel-source power generation technologies (nuclear, coal, and renewables).

—Dr. Robert Peltier, PE is editor-in-chief of POWER. Kennedy Maize is Executive Editor of MANAGING POWER

OT, but what do you think of economist Jeff Rubin’s prediction of $225 oil by 2012?

I was surprise to read the following:

“A recent Washington Post article quoted anonymous sources as saying that new nuclear plants aren’t economical until natural gas prices are above $7/mmBtu. That’s more than double the current price.”

That statement indicates that you think that natural gas is selling for $3.50 per million BTU. I did a double take and then checked the date of your post, wondering if I was reading old news. But no, your post is dated Jan 13, 2009.

I took a quick look at the commodity energy price page on bloomberg.com for today, Jan 15, 2009.

Here is the result:

NYMEX HENRY HUB FUTURE 5.69 .10 1.84 01/15

HENRY HUB SPOT 5.68 -.10 -1.73 01/15

NEW YORK CITY GATE SPOT 6.15 -.12 -1.91 01/15

In other words, natural gas is not selling at $3.50 per million BTU. Even at the hubs, it is much closer to $7 than you imply. If you look back just a few days ago, when it was pretty darned chilly on the East Coast, the New York City Gate price remained above $10 per MMBTU for several days.

We have had a dash for gas before. So has the UK. The results are not so good when everyone starts buying the same limited supply commodity. (There might be plenty of gas in the ground, but how fast can it be extracted?)