Alaska Bad Bill 1: Clean Energy Standards (HB 368)

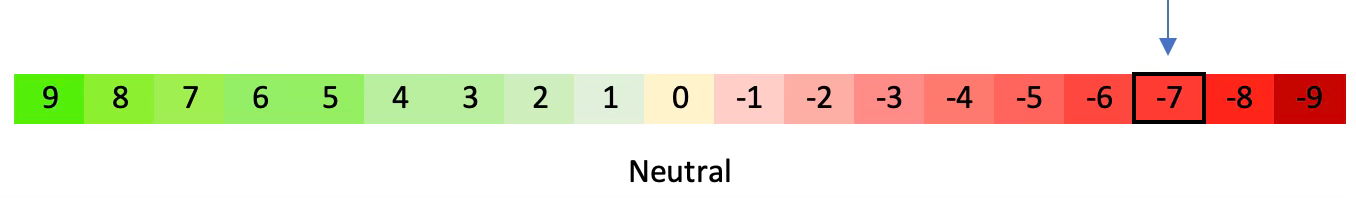

By Kassie Andrews -- April 3, 2024“The score for this bill in its present state is a -7 with -9 being the worst, 0 neutral, and +9 being the best for freedom and liberty.”

HB 368 was introduced by Representative George Rauscher, chair of the Special House Energy Committee. Clean Energy Standards (CES) is the evil twin of the Renewable Portfolio Standard, Despite, the claim by this committee that there are no penalties for utilities to contend with, its just smoke-and-mirrors in terms of ratepayer welfare, energy reliability, and economic freedom from energy statism.

On March 22, 2024, the House Special Committee on Energy advanced the bill out of committee by a vote of 4-3 to establish a CES under HB 368. The purpose of the bill is “to establish a clean energy standard that requires certain electric utilities to derive increasing percentages of the utility’s net electricity sales from clean energy sources.”

The following individual recommendations were recorded: Do pass (2): Baker (R-Barrow), Rauscher (R-Sutton); Do not pass (2): Prax (R-North Pole), McKay (R-Anchorage); No recommendation (2): Armstrong (D-Anchorage), Wright (R-Anchorage); Amend (1): Schrage (NA-Anchorage)

This legislation, with the amendments approved in session, increase the tax credit, allows for Independent Power Producers (IPPs) to take advantage of the tax credit, and allows for a school district to apply for the tax credit. There were no fiscal notes present at the time of review but were uploaded when the bill was transferred from the Special Committee on Energy to the Finance Committee.

There was unanimous public testimony in opposition to the bill. The Republican majority continues to defend their position that the utilities are asking for this legislation and continue to state that this legislation doesn’t create a mandate. The fatal flaw in that argument is that every utility already has a published decarbonization plan where this is a key component needed for their stated outcome. The costly and ineffective features as part of what defines clean energy in this bill aim to make wind and solar appear affordable.

This CES is bad but remember the goal is the transmission upgrades and fully integrated Railbelt Transmission System. If the upgrade required under this subsection is not completed before December 31, 2026,

(1) 35 percent of sales in the load-serving entity’s portfolio must be from clean energy within 10 years after the upgrade is complete; and

(2) 60 percent of sales must be from clean energy within 25 years after the upgrade is complete, or when electric power transmission lines connect the interconnected electric energy transmission network in the Railbelt to the service area of the Copper Valley Electric Association, whichever is later.

This is a no-win situation when the utilities have the pieces in place to execute their plan, communicated their desire for wind and solar only, and got on board with having this legislation passed. There were amendments that would have made this legislation useless, but they were pulled from discussion; why we will never know. The green energy legislators have the Republicans right where they want them, chasing easy money and appeasing business interests over individual liberty.

In the end, the rate payer loses. This is demonstrated in the detailed legislative scoring:

The score for this bill in its present state is a -7. With -9 being the worst, 0 neutral and +9 being the best for freedom and liberty.

1. Expand/Contract Government?

Does it create, expand or enlarge an agency, board or function/activity of government? Conversely, does it reduce the size/scope of government?

Score -1. This bill increases the size of government. The fiscal note at present is 1.7M through FY 2030 for a full time equivalent and consultant to setup the regulation changes.

2. Govt Free-Market Interference?

Does it give the government any new/expanded power to prohibit, restrict or regulate the free market? Conversely, does it eliminate/reduce govt intervention in the free market?

Score -1. This bill does give the government power to prohibit and restrict the free market. The bill defines new “standards” that pigeonhole utilities into adoption of a defined set of energy sources, rather than the most economical and reliable. Utilities may not bring on a large energy facility if it is detrimental to the clean energy standards as defined in the bill.

3. Creates / Removes Barriers to Enter Market?

Does it increase barriers to entry into the market? Conversely, does it remove barriers to market entry?

Score -1. The market for solar and wind is forced and fixed. All this legislation does is lock things up so that we will never have a free market. This is taking the open market and subjecting it to corrupt crony controls.

4. Increase Taxes, Fees, Etc.

Direct/Indirect increase of taxes, fees/assessments? Conversely, does it reduce them?

Score -1. This bill incentivizes the clean energy standard by use of a tax credit. In no way will this bill end with the reduction of taxes or fees.

5. Increase Govt Spending?

Does it increase govt spending or debt? Conversely, does it reduce govt spending/debt?

Score -1. This bill increases spending by adding more government to the Regulatory Commission of Alaska. This bill provides for a 0.2 cent per kwh subsidy for clean energy standard generation. Per an amendment offered by Representative Baker, this bill adds one cent per kwh for electric utilities that receives power cost equalization subsidies. An amendment offered by Representative Rauscher to increase the tax credit from 0.2 cents to 2 cents was estimated to cost over half a billion dollars (655M) to the state in the next 20 years. The only supporters of this amendment were Republican Representatives Baker, Wright and Rauscher. Thankfully this amendment failed.

6. Govt Growth/Displace Private Sector

Does it grow government by displacing the private sector in the market? Conversely, does it eliminate or return a function of government to the private sector?

Score 0. Indirectly it will grow NGOs and ENGOs which are subsidized by the government.

7. Govt Redistribution of Wealth Tax Policy Reward Special Interests

Does it increase govt. redistribution of wealth? Tax policy to reward special interests/businesses/govt. employees. Conversely does it decrease govt. redistribution?

Score -1. The major component of this bill is about subsidizing the behavior of our utilities through tax incentives. The IPPs (Independent power producers) and the NGOs that support them are special interests that require massive subsidies (federal and now state) to claim affordability. Additionally and in parallel, the requirement for us to build the infrastructure for the ability for IPPs to exist at all as shown in Curtis Thayer’s testimony appealing to the state that we need over $200M in match funding to transform our grid to allow IPPs onto it. Per this bill by an approved amendment offered by Representative Schrage, IPPs will get clean energy tax incentives as well.

8. Restrict Public Access to Information?

Does it restrict public access to information related to govt. activity or reduce accountability? Conversely, does it increase government transparency/accountability?

Score 0. Although this bill doesn’t restrict public access related to government activity, this bill adds layers of complexity to an already complex energy system. It reduces accountability to the utility and the utility boards that represents the rate payer when the state creates laws that affect the rate payer. Laws to mandate how and when a utility derives their energy makeup skews the relationship between the utility provider and the end user, thus resulting in less clear information and reduced accountability. Interestingly, non-governmental organizations have more access and influence than private citizens, they are writing legislation and invited in as expert testimony to support what they authored. This rating could very well be -1.

9. Violate U.S. Constitution or Alaska Constitution

Does it violate the spirit or the letter of either the U.S. Constitution or the Alaska Constitution? Conversely, does it uphold either of those constitutions?

Score -1. Our forefathers never foresaw the problem we are having with the federal reserve and inflation – inflation is the mother of all taxes. Taxation without representation. This bill issues mandates for utilities to adopt prescript and expensive sources of energy. This indirect tax, along with the energy tax credits are taxes to which the state is not responsible to the people for. This legislation is also in conflict with the Alaska Constitution Article 8 – “It is the policy of the State to encourage the settlement of its land and the development of its resources by making them available for maximum use consistent with the public interest.” This energy crisis is manufactured. This bill ensures that our affordable sources of energy remain in the ground.

Total Score -7.

This bill is now headed to the House Finance Committee where hearings have not yet been scheduled.

Prior posts of Kassie Andrews, a principle at MasterResource, can be found here.

Please fix the Masterresource.org RSS feed. It has not worked for over a year,