Houston’s Robust Fossil Future (Chronicle’s CERAWeek op-ed misdirects)

By Allen Brooks -- March 25, 2024“Do we need a clean energy industry that depends on government handouts forever? Yes, if you ascribe to the climate disaster mantra…. Does anyone consider letting market forces drive technology development?”

An op-ed in Monday’s Houston Chronicle, “Houston is making a losing bet on fossil fuels,” greeted visitors to CERAWeek. Author Randall Morton attacked oil company CEOs and Houston business leaders for defending a “declining” industry. His opening sentence? “Leaders of the oil and gas industry are in Houston for CERAWeek, grappling with the inevitable decline of the industry.”

Morton then goes after the “economic development leaders at the Greater Houston Partnership [who] are doubling down on this declining industry.” He specifically identifies the GHP’s Energy Transition Initiative – hydrogen and carbon capture – as failed technologies.

Fair enough, but he misses a critical point. These technologies are less about betting on “fading fossil fuels” than they are decisions to suck on the federal teat of subsidies. That reality was acknowledged by Energy Secretary Jenifer Granholm in her CERAWeek talk when she told the audience, “Many of you are taking advantage of those irresistible tax credits. Good!” (No mention from any federal officials about the deficit spending and monetary inflation used to pay for it.)

Subsidies Are for Losers

Changing human behavior, which is what subsidies are designed to accomplish, apparently doesn’t sway Morton. Maybe he wants even more government money for his favorite technologies, but he never tells us what those might be. He fails to understand an Economics 101 point: The market picks winners, leaving losers for government. And losers they have proven to be to date, not unlike synthetic fuels of a half century ago.

“Inflation Reduction Act”

There seemed to be no shortage of taxpayer money being thrown at green energy technologies, based on the legislation passed in 2021 and 2022. First, there was the Infrastructure Investment and Jobs Act of 2021, then it was the Inflation Reduction Act of 2022 (IRA). The former included a laundry list of favorite climate investments to help localities deal with the clean energy transition including $7.5 billion for electric vehicle charging stations, $5 billion for zero-emission and clean buses, $2.5 billion for clean ferries, and $65 billion for clean energy transmission.

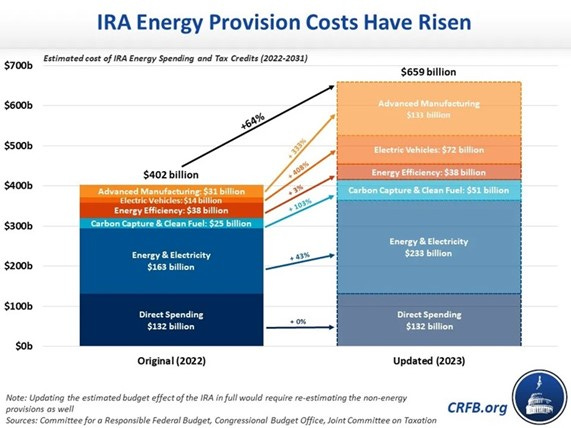

The irresponsibly named IRA bill was a trove of subsidies and tax credits for clean energy. The Congressional Budget Office at the time of its passage estimated the bill to cost $391 billion between 2022 and 2031. An analysis by investment firm Goldman Sachs put the cost at $1.2 trillion, while a money manager estimated it at $1.4 trillion. Even the CBO has upped its initial cost estimate to $660 billion through 2031 and increased it to $786 billion for 2024-2033. Many of these subsidies, which originally had time limits, have had them removed—allowing subsidies for the life of projects, further bloating the cost of the bill.

The Committee for a Responsible Federal Budget wrote about the CBO’s revised estimates. They included two charts that dramatically show how much the various categories of spending are projected to increase and how those spending categories will spread over the forecast periods.

The Inflation Reduction Act conservatively has increased by nearly two-thirds since it was enacted in 2022.

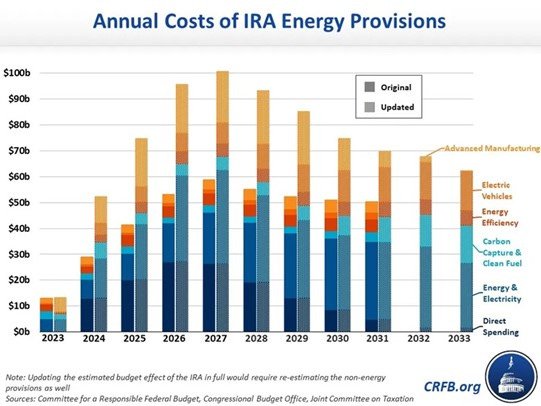

You will note the magnitude of the spending increases. They will be even greater according to Goldman Sachs. For categories of green energy spending like electric vehicles, energy efficiency, and carbon capture & clean fuel, they will be much greater in 2031 and 2033.

Many of the subsidies in the IRA will continue for well after the 10-year cost assessment period inflating the overall cost of the bill.

In the world of industrial policy, which the Biden administration is engaged in, the question becomes should one reject the government’s free money? For Morton, no one should succumb to the siren song of subsidies, even if they were enacted to prompt these specific investments. Shunning the subsidies would open companies and CEOs to attacks from activists and politicians for not being patriotic and supporting the government’s effort to solve the existential climate crisis. And they could be slammed by shareholders for accelerating their company sunsets.

Do we need a “clean” energy industry? How about one that depends on government handouts forever? Yes, if you ascribe to the climate disaster mantra. How many years do we have before the world ends? This fear is what is driving the shoveling of taxpayer money into corporate coffers as long as they make the “correct” investments. Does anyone consider letting market forces drive technology development?

The Coal Question

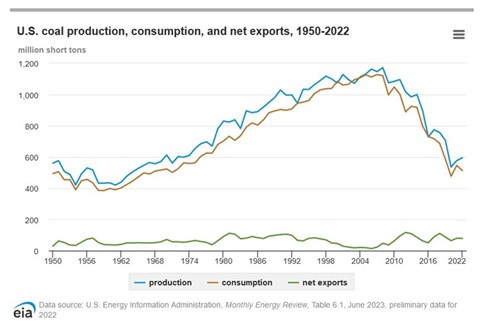

Some of the claims Morton made were superficial at best. He tried to link Big Oil to King Coal. He was using the decline in U.S. coal production and the reduction in coal employment as the lesson for oil’s future.

Our coal production has declined as shown in the chart below, but as you can see in the second chart, our coal exports are up and we continue to import coal at about the same level as we did in the late 1990s. Coal’s decline was because we are blessed with huge natural gas resources that create less pollution.

Our coal use is down due to soaring natural gas production and lower cost to generate electricity.

Coal exports continue growing and our imports are up as global coal markets are posting annual records with no end in sight.

Final Word

Energy has turned into a subsidy play, something for everyone. Yes, so-called Big Oil is at the table. One can join Randall Morton in calling out hydrogen and CCSU as the wrong approach. But why not consider ending similar government favor for wind, solar, and batteries? Do consumers and taxpayers–and the freedom to choose–matter?

Energy expert Allen Brooks writes at Energy Musings, from which this article is adapted.